Cost Increases for Extended Health & Dental Plans

Canadian employers continue to experience year-over-year increases in the costs of their extended health benefit and dental plans.

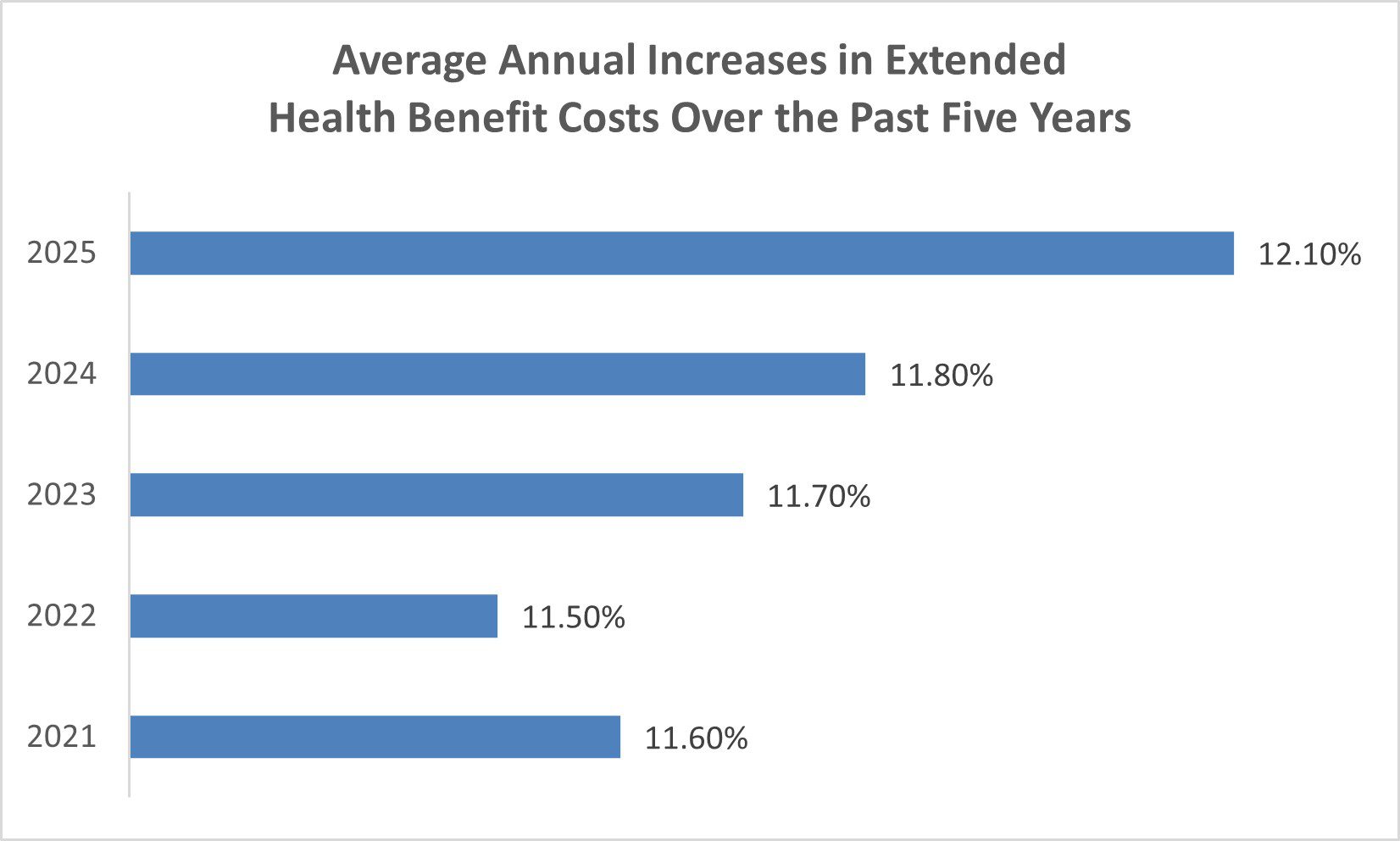

Western Compensation & Benefits Consultants conducts an annual survey of insurers’ extended health and dental trend and utilization factors. These factors reflect the insurers’ anticipated increases in health and dental costs. WCBC’s 2025 survey indicates that the 2025 increases will be similar or higher than the magnitude of cost increases in the previous four years.

Extended Health Benefits

Annual increases in extended health benefits costs result from a number of factors, including:

-

- Impact of rising costs of drugs, services and supplies;

- Increasing utilization of extended health benefits by covered employees and their dependents, especially for paramedical services and high-cost specialty drugs;

- Increasing use of high-cost specialty drugs to treat a broader number of more common diagnoses;

- Increasing costs of providing more support for mental health;

- Expansion in the types of benefits covered i.e. gender affirmation, women’s health, etc.

- Removal or reduction of covered services from the government sponsored plans (e.g. Medical Services Plan of B.C.);

- An aging population; and

- A greater awareness of health and wellness.

The insurers’ anticipated average annual increases in extended health costs in 2025 and the actual increases in the previous four years are displayed in the graph above. As shown, the anticipated annual increase in 2025 is the highest. This is a reflection of the cost factors discussed above.

Dental

Increases in dental costs result from two main factors, including: increases in the fees charged by dentists coupled with increases in the utilization of the plans by covered employees and their dependents. Utilization is influenced by factors in the economy and the introduction of new dental procedures.

The provincial dental fee guides contain recommended fees to be charged by dentists for various dental procedures and services. Insurers use the guides as a benchmark for determining reimbursement levels for dental care. Over the past two years, dental fee guide increases have dropped from a historical high of 5% to 10% during COVID down to pre-COVID increases in the range of 1% to 4%. The higher increases during and after COVID were caused by two factors, including: the additional cost of preventative safety measures (i.e.: masks, face shields, gowns, air purifiers, etc.) and the increases in the cost of supplies, labour, and overhead.

The table below shows the average increases in the provincial/territorial dental fee guides over the past three years. Some insurance companies base their increases solely on the fee guide increases, while other insurance companies also consider claims data. The average increase in plan utilization is shown at the bottom of the table. With the combined impact of increases in the dental fee guides and the increases in plan utilization, the insurers overall anticipated dental cost increase is between 8.03% and 12.4%, depending on the province/territory.

Increases in Dental Plan Costs

| Average Increase Based on Dental Fee Guide | |||

|---|---|---|---|

| Province/Territory | 2023 | 2024 | 2025 |

| British Columbia | 5.99% | 4.73% | 3.27% |

| Alberta | 6.00% | 3.62% | 4.12% |

| Saskatchewan | 5.62% | 3.97% | 3.97% |

| Manitoba | 5.25% | 4.90% | 3.10% |

| Ontario | 8.50% | 4.80% | 2.03% |

| Quebec | 9.80% | 5.70% | 4.50% |

| New Brunswick | 5.90% | 4.70% | 4.70% |

| Newfoundland & Labrador | 8.50% | 4.00% | 4.00% |

| Nova Scotia | 5.92% | 4.73% | 3.81% |

| Prince Edward Island | 4.88% | 4.65% | 4.65% |

| Northwest Territories | 6.00% | 4.00% | 4.00% |

| Nunavut | 6.00% | 4.00% | 4.00% |

| Yukon | 4.00% | 4.70% | 4.00% |

| Average Increase in Plan Utilization | |||

| All Provinces/Territories | 5.18% | 6.10% | 6.80% |

The graph to the right displays the average insurer’s actual and anticipated annual increases in dental plan costs over the past five years, including fee guide increases and utilization. As shown, the anticipated dental increase this year is lower than the prior two years.

Summary

Trend and utilization factors should be used to project the increases required in premium rates and/or deposits to ensure that extended health and dental plans are appropriately funded. However, the biggest driver of plan costs increases is the claims actually incurred by an organization’s own employees. It is therefore important to regularly review the financial experience (i.e.: claims incurred vs. premiums), the appropriateness of the funding (or risk sharing) arrangements and expenses charged by the insurance company, as well as the trend and utilization factors, to determine the appropriate renewal rates for the extended health and dental plans.

Please contact Giovanna Lau, Director, Employee Benefits at WCBC for your benefits needs.

604-443-3703 | giovanna_lau@wcbc.ca