Why Inflation & Salary Increases Are Different

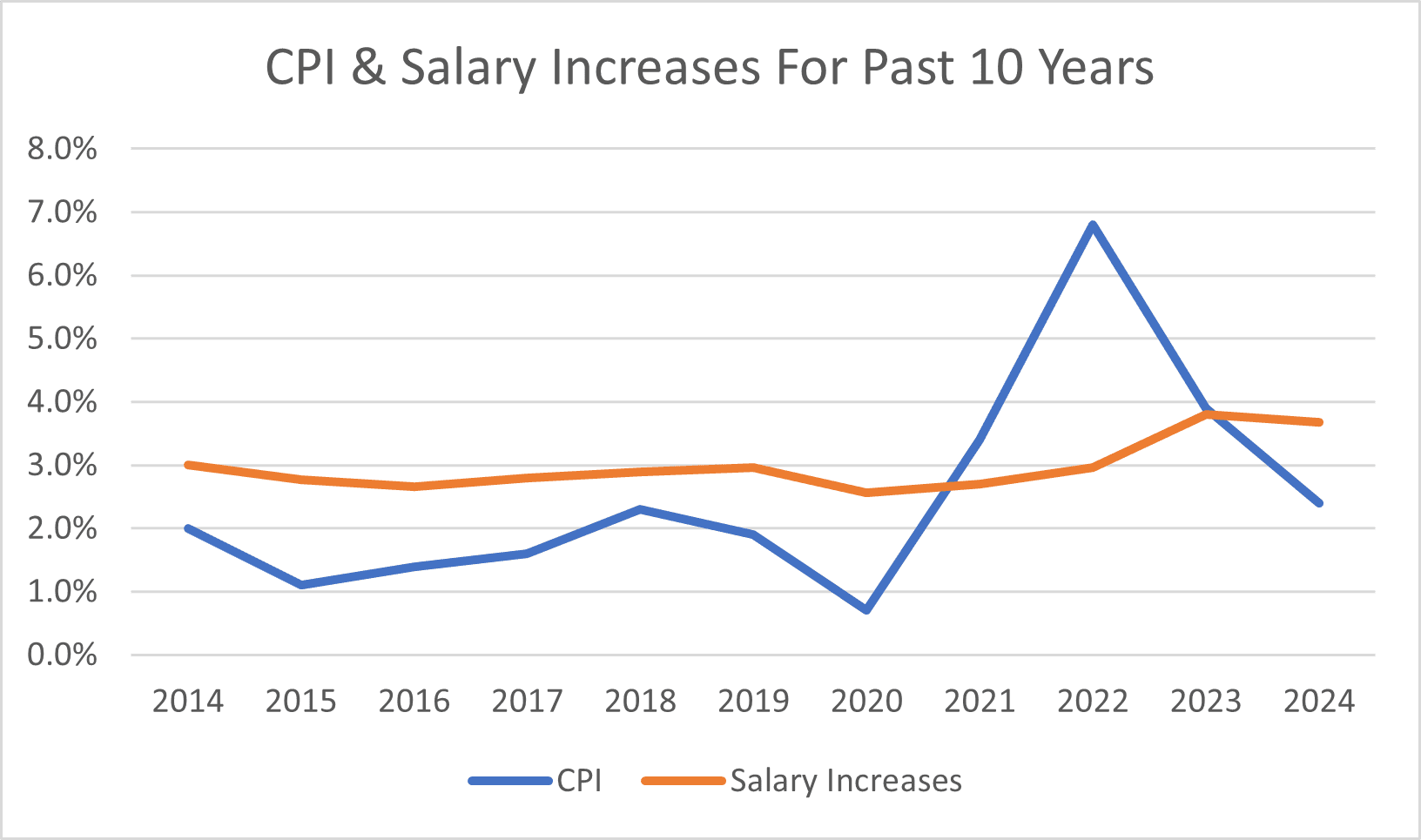

Determining fair and equitable salary increases is a crucial aspect of any organization’s governance. However, relying solely on metrics like cost-of-living adjustments (COLA) or changes in the Consumer Price Index (CPI) might not be the most effective approach. Although inflation and salary increases generally move in the same direction, they are driven by different factors.

Understanding the Consumer Price Index (CPI)

The CPI is a measure that examines the average change in prices paid by consumers for goods and services over time. It is one of the most commonly used indicators of inflation, providing important information about changes in the cost of living for households.

The CPI is calculated by collecting price data for a representative basket of goods and services commonly purchased by urban consumers. These items include food, housing, clothing, transportation, medical care, and various other goods and services. The prices for these items are tracked over time, and changes in prices are weighted according to the relative importance of each item in the average consumer’s spending pattern.

The CPI is widely used by economists, policymakers, businesses, and individuals to monitor inflation, adjust economic policies, and make financial decisions. It provides valuable insights into changes in the cost of living and helps stakeholders understand how price changes affect consumers’ purchasing power over time.

Understanding Cost-Of-Living Adjustments (COLA)

Employers are not legally required to provide cost-of-living adjustments, however, some union contracts may include COLA pay as part of their terms. For most employers, cost-of-living adjustments are entirely discretionary.

COLA is an increase in wages or benefits or pensions, to offset the effects of inflation. It is designed to help maintain the purchasing power of an individual’s income or benefits in the face of rising prices for goods and services.

COLAs are often tied to an index, such as the Consumer Price Index (CPI). When the index rises, indicating an increase in the cost of living, COLAs are triggered to ensure that incomes or benefits keep pace with the rising prices.

Differentiating COLA and CPI from Market Movement

It’s crucial to recognize that COLA/CPI are not synonymous with market movement. While they capture broad economic trends, they may not accurately reflect the specific market conditions or individual circumstances that impact employees. Market movements encompass various factors such as industry demand, skill shortages, organizational performance, and individual contributions—all of which might not be adequately captured by COLA/CPI. Limitations of using COLA/CPI as sole determinants for salary increases are summarized below:

While COLA/CPI offer valuable insights into economic trends, using them as sole determinants for salary increases isn’t conducive to good governance. Organizations should adopt a more holistic approach to compensation management, considering individual performance, market dynamics, and long-term strategic objectives. By moving beyond COLA/CPI adjustments, organizations can foster a fair and competitive compensation culture that incentivizes excellence and supports sustainable growth.

How Can WCBC Help?

At our firm, specialization is key. We’re a dedicated team singularly focused on compensation and benefits consulting. Unlike general HR firms that cover a broad spectrum of human resources functions, our expertise lies in the nuanced landscape of optimizing compensation structures and benefit packages. This laser focus allows us to stay at the forefront of industry trends, regulations, and best practices, providing our clients with tailored, informed, and innovative solutions that drive both their organizational and employee success.

Options:

WCBC annually publishes a Salary Increase report. The report captures data from across Canada and includes data from hundreds of organizations. Results are released annually before Labour Day. Check out our Salary Surveys webpage to find out more.